Exploring the realm of finding affordable general liability insurance for contractors, this guide offers valuable insights and practical tips in navigating the complex world of insurance. From understanding the importance of coverage to strategies for cost-saving, this guide is a must-read for contractors seeking financial protection.

Importance of General Liability Insurance for Contractors

General liability insurance is a crucial safeguard for contractors to protect their business from unforeseen risks and potential financial losses. It provides coverage for various situations that may arise during the course of their work, giving contractors peace of mind and financial security.

Coverage for Potential Risks

- Property Damage: General liability insurance can cover the costs associated with damage to a client's property caused by the contractor's work.

- Bodily Injury: In case a third party is injured on the job site, this insurance can help cover medical expenses and legal fees.

- Advertising Injury: Protection against claims of slander, libel, or copyright infringement arising from advertising your services.

- Completed Operations: Coverage for claims related to work completed by the contractor, even after the project is finished.

Consequences of Not Having Insurance

Without general liability insurance, contractors are exposed to significant financial risks that could potentially bankrupt their business. In the event of a lawsuit or claim, the contractor would be personally responsible for covering legal fees, settlements, and damages, which can result in severe financial hardship and even closure of the business.

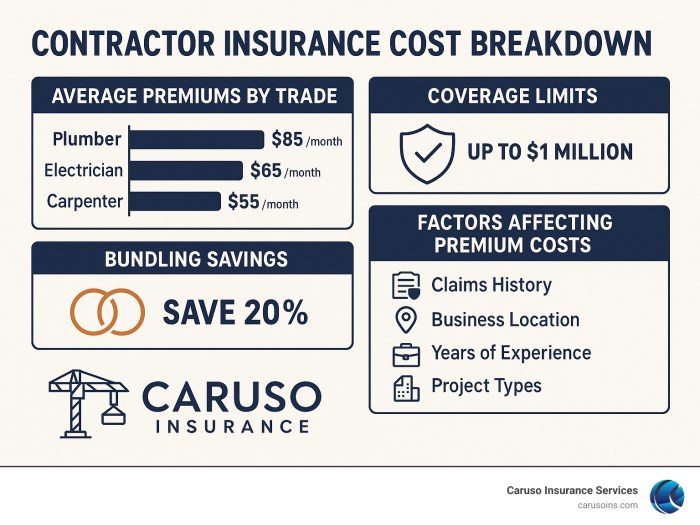

Factors Influencing the Cost of General Liability Insurance

When it comes to general liability insurance for contractors, several key factors influence the cost of coverage. Understanding these factors can help contractors make informed decisions when purchasing insurance.

Nature of the Contractor's Work

The nature of the contractor's work plays a significant role in determining the cost of general liability insurance. Contractors who work in high-risk industries, such as construction or roofing, are likely to face higher insurance premiums due to the increased likelihood of accidents or property damage.

- Contractors involved in hazardous activities or those working at heights may be charged higher premiums.

- Insurance companies assess the level of risk associated with the contractor's work to determine the cost of coverage.

- Contractors who have a history of claims or lawsuits filed against them may also face higher insurance costs.

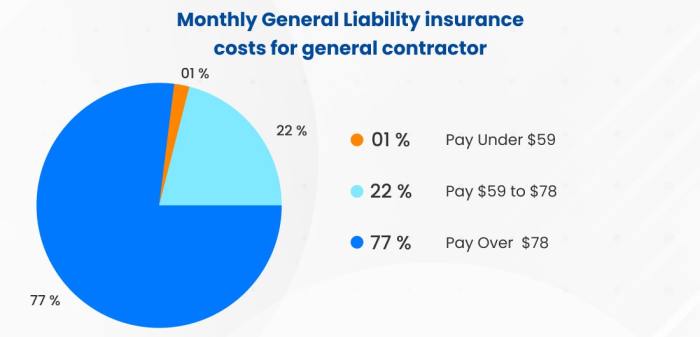

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by contractors can also impact the cost of general liability insurance. Higher coverage limits and lower deductibles typically result in higher premiums, while lower coverage limits and higher deductibles can reduce insurance costs.

- Contractors should carefully consider their coverage needs and financial capabilities when selecting coverage limits and deductibles.

- Higher coverage limits provide more extensive protection but come with higher costs.

- Choosing higher deductibles can help lower premiums, but contractors must be prepared to pay more out of pocket in the event of a claim.

Strategies to Find Affordable General Liability Insurance

Finding affordable general liability insurance is crucial for contractors to protect their business without breaking the bank. Here are some strategies to help contractors find cost-effective coverage:

Comparing Quotes from Different Insurance Providers

- Obtain quotes from multiple insurance companies to compare rates and coverage options.

- Consider working with an independent insurance agent who can help you navigate different policies and find the best deal.

- Look for insurance providers that specialize in working with contractors, as they may offer more tailored and affordable options.

Reviewing Policy Details for Adequate Coverage at Lower Cost

- Ensure you understand the coverage limits, exclusions, deductibles, and any additional features included in the policy.

- Avoid paying for unnecessary coverage that doesn't apply to your specific contracting business.

- Consider bundling general liability insurance with other types of insurance, such as property or auto, to potentially receive a discount.

Exploring Discounts and Cost-Saving Options

- Ask about discounts for paying the full premium upfront or for having a claims-free history.

- Consider increasing your deductible to lower your premium, but make sure you can afford the out-of-pocket costs in case of a claim.

- Participate in risk management programs or training to potentially qualify for lower insurance rates.

Benefits of Working with an Insurance Broker

Insurance brokers play a crucial role in helping contractors find cost-effective general liability insurance. These professionals have industry expertise and can leverage their knowledge to secure better deals for their clients. Here are some key benefits of working with an insurance broker:

Role of an Insurance Broker

- Insurance brokers act as intermediaries between contractors and insurance companies, helping contractors navigate the complexities of insurance policies and find the most suitable coverage.

- Brokers assess contractors' specific needs and risks to recommend tailored insurance solutions that provide adequate protection.

- They have access to a wide network of insurance providers, allowing contractors to compare multiple quotes and choose the most cost-effective option.

Choosing a Reputable Insurance Broker

- Look for brokers who specialize in commercial insurance and have experience working with contractors in your industry.

- Check the broker's credentials, such as licenses and certifications, to ensure they meet professional standards and regulations.

- Read reviews and testimonials from other contractors to gauge the broker's reputation and reliability.

- Consider the broker's communication style and responsiveness, as effective communication is essential for a successful partnership.

Final Thoughts

In conclusion, finding cheap general liability insurance is a crucial step for contractors to safeguard their business against unforeseen risks. By following the strategies and tips Artikeld in this guide, contractors can secure the coverage they need at a price that fits their budget.

Popular Questions

What are some key factors that influence the cost of general liability insurance?

Factors such as the nature of the contractor's work, coverage limits, and deductibles can impact the cost of general liability insurance.

How can contractors find affordable general liability insurance?

Contractors can compare quotes from different providers, review policy details for adequate coverage, and explore discounts or cost-saving options.

Why is general liability insurance important for contractors?

General liability insurance provides essential financial protection against potential risks and liabilities that contractors may face in their line of work.

What role does an insurance broker play in helping contractors find insurance?

An insurance broker can leverage their industry knowledge to assist contractors in finding cost-effective general liability insurance and securing better deals.