Exploring Medibank Life Insurance Review: Is It Worth the Price? brings to light a comprehensive analysis that delves into the offerings of this insurance provider. This introductory passage sets the stage for a detailed examination, inviting readers to uncover the true value of Medibank's policies.

Further details about the topic are elaborated in the subsequent paragraph.

Introduction to Medibank Life Insurance

Medibank Life Insurance offers a range of insurance products designed to provide financial protection for you and your loved ones in the event of unexpected circumstances. Whether it's covering funeral expenses, paying off debts, or providing income replacement, Medibank Life Insurance aims to offer peace of mind and security.

Key Features of Medibank Life Insurance

- Flexible policy options to suit individual needs and budget

- Coverage for terminal illness diagnosis

- Add-on benefits such as funeral advancement benefit

- Option to increase or decrease coverage as needed

Comparison with Other Insurance Providers

When comparing Medibank Life Insurance with other insurance providers in the market, it is important to consider factors such as coverage options, premiums, customer service, and reputation. While Medibank Life Insurance offers competitive features and flexibility, it is advisable to research and compare multiple providers to find the best fit for your specific needs.

Coverage and Benefits

When it comes to Medibank Life Insurance, the coverage and benefits provided are crucial factors to consider when deciding if it's worth the price. Let's delve into the different types of coverage offered and the benefits included in Medibank Life Insurance policies.

Types of Coverage

- Life Cover: This provides a lump-sum payment to your beneficiaries in the event of your death.

- Total and Permanent Disability (TPD) Cover: Offers financial support if you become totally and permanently disabled.

- Critical Illness Cover: Gives you a lump-sum payment if you are diagnosed with a critical illness like cancer or heart disease.

Benefits Included

- Financial Security: Medibank Life Insurance ensures your loved ones are financially protected in case of unforeseen events.

- Peace of Mind: Knowing that you have coverage can provide peace of mind and alleviate stress during difficult times.

- Flexible Premiums: Medibank offers flexible premium options to suit your budget and needs.

Real-Life Scenarios

"After being diagnosed with a critical illness, I received a lump-sum payment from Medibank Life Insurance, which helped cover my medical expenses and allowed me to focus on my recovery without worrying about finances."

"The Life Cover provided by Medibank ensured that my family was taken care of financially after my passing, giving me peace of mind knowing they would be secure."

Pricing and Affordability

When it comes to choosing a life insurance policy, the cost is a significant factor to consider. Let's delve into the pricing structure of Medibank Life Insurance and see if it offers good value for money.

Medibank Life Insurance Pricing Structure

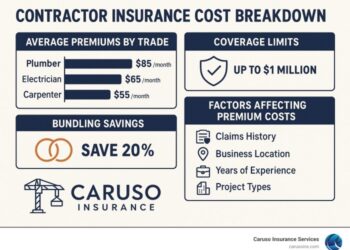

Medibank Life Insurance offers competitive pricing based on factors such as age, gender, smoking status, and coverage amount. Premiums are tailored to individual needs, ensuring that policyholders pay a fair and affordable price for their coverage.

Comparison with Similar Insurance Products

To determine if Medibank Life Insurance is worth the price, it's essential to compare it with similar insurance products in the market. By evaluating the coverage, benefits, and premiums of different policies, you can make an informed decision on which one offers the best value for your money.

Discounts and Offers

Medibank Life Insurance may offer discounts or special offers to policyholders, such as multi-policy discounts or loyalty rewards. These incentives can help reduce the overall cost of the policy, making it more affordable for individuals and families looking to protect their financial future.

Customer Experience and Satisfaction

When it comes to choosing a life insurance provider, customer experience and satisfaction play a crucial role in determining the reliability and quality of service. Let's take a closer look at what customers have to say about Medibank Life Insurance.

Customer Reviews and Testimonials

- Many customers have praised Medibank Life Insurance for their efficient and prompt customer service. They appreciate the quick response times and helpful guidance provided by the customer support team.

- Several policyholders have shared positive experiences regarding the hassle-free claims process offered by Medibank Life Insurance. They found the claims settlement to be smooth and transparent.

- Customers have also expressed satisfaction with the comprehensive coverage options available through Medibank Life Insurance, tailored to meet individual needs and preferences.

Overall Customer Experience

- Medibank Life Insurance has been known to prioritize customer satisfaction, evident from the positive feedback received from policyholders across various platforms.

- The company's user-friendly online portal and mobile app have been commended for their ease of navigation and accessibility, enhancing the overall customer experience.

- Policyholders value the personalized attention and support provided by Medibank Life Insurance advisors, ensuring a seamless experience throughout the policy term.

Awards and Recognition

- Medibank Life Insurance has received accolades for its commitment to customer satisfaction, earning recognition in the insurance industry for excellence in service delivery.

- The company's dedication to enhancing the customer experience has been acknowledged through awards and accolades, reinforcing its reputation as a trusted life insurance provider.

Claim Process and Settlement

When it comes to life insurance, the claim process and settlement are crucial aspects that policyholders rely on during difficult times. Understanding how Medibank Life Insurance handles claims can provide insight into the efficiency and reliability of their services.

Efficient Claim Processing

- Policyholders can initiate a claim by contacting Medibank Life Insurance either online or through their customer service hotline.

- Upon receiving the necessary documents and information, Medibank Life Insurance assesses the claim promptly to determine its validity.

- Claims are processed efficiently to ensure that policyholders receive the financial support they need in a timely manner.

Successful Claim Settlements

- Medibank Life Insurance has a track record of successful claim settlements, providing financial assistance to beneficiaries when a claim is approved.

- Examples of successful claim settlements include payouts for terminal illnesses, accidental deaths, and other covered events, demonstrating the company's commitment to supporting its policyholders.

- Policyholders have reported positive experiences with Medibank Life Insurance's claim settlement process, citing quick responses and smooth transactions.

Final Wrap-Up

In conclusion, Medibank Life Insurance Review: Is It Worth the Price? encapsulates the essence of this discussion, leaving readers with a succinct yet informative summary of the key points explored.

Top FAQs

What types of coverage does Medibank Life Insurance offer?

Medibank Life Insurance offers various coverage options such as term life insurance, total and permanent disability cover, and income protection.

Are there any discounts available for Medibank Life Insurance policies?

Medibank Life Insurance may offer discounts for bundling policies, healthy lifestyle choices, or loyalty programs.

How does the claim process work with Medibank Life Insurance?

Claiming with Medibank involves submitting necessary documentation, after which the claim is assessed and processed for settlement.