Exploring the significance of liability insurance for service providers, this introduction sets the stage for a deep dive into the topic. With a blend of informative insights and practical examples, readers are invited to understand why this type of insurance is crucial in today's service-oriented landscape.

As we navigate through the intricacies of liability insurance, we will uncover key aspects that highlight its necessity and advantages for service providers of all kinds.

Importance of Liability Insurance

Liability insurance is a crucial safeguard for service providers, protecting them from potential financial losses and legal liabilities that may arise during the course of providing services to clients.

Protection Against Lawsuits

Liability insurance provides coverage in the event of lawsuits filed against service providers for negligence, errors, or omissions in their services. For example, a client may file a lawsuit claiming financial losses due to inadequate services provided by a service provider, and liability insurance can help cover legal fees and settlement costs.

Coverage for Property Damage or Bodily Injury

In scenarios where a service provider accidentally damages a client's property or causes bodily injury to a third party while on the job, liability insurance can step in to cover the costs of repairs, medical expenses, or legal claims. Without this coverage, service providers could face substantial financial burdens.

Professional Reputation Protection

Having liability insurance can also protect a service provider's professional reputation in the event of unforeseen circumstances. By having coverage in place, service providers can demonstrate their commitment to accountability and financial responsibility to clients, enhancing trust and credibility.

Types of Liability Insurance

When it comes to protecting service providers from potential risks and liabilities, there are different types of liability insurance available. Two common types are general liability insurance and professional liability insurance. Let's compare and contrast these two types and discuss their specific coverage areas.

General Liability Insurance

General liability insurance provides coverage for common risks that service providers may face, such as bodily injury, property damage, and advertising injury. This type of insurance is essential for protecting businesses from lawsuits related to accidents or negligence. It typically covers legal fees, settlements, and medical expenses in case of a covered claim.

- Provides coverage for bodily injury and property damage

- Protects against advertising injury claims

- Offers coverage for lawsuits and legal fees

Professional Liability Insurance

Professional liability insurance, also known as errors and omissions insurance, is specifically designed to protect service providers from claims of negligence or inadequate work. This type of insurance is crucial for professionals who provide advice, services, or expertise to clients.

It covers legal fees, settlements, and damages resulting from claims of professional errors or omissions.

- Protects against claims of negligence or inadequate work

- Covers legal fees, settlements, and damages

- Specifically tailored for professionals in various industries

Legal Requirements and Compliance

When it comes to liability insurance for service providers, there are legal requirements that must be met to ensure compliance with regulations and protect both the service provider and their clients. Failure to comply with these requirements can result in legal consequences and financial liabilities.

Industry-Specific Regulations

In different industries, there are specific regulations related to liability insurance that service providers must adhere to. For example, in the healthcare industry, medical professionals are required to have malpractice insurance to protect against claims of negligence or errors in patient care.

Similarly, in the construction industry, contractors are often required to have liability insurance to cover accidents or property damage on job sites.

- It is essential for service providers to understand the specific regulations in their industry and ensure that they have the appropriate liability insurance coverage in place.

- By complying with industry-specific regulations, service providers can demonstrate their commitment to professionalism and accountability, which can help build trust with clients and stakeholders.

- Failure to comply with these regulations can not only result in legal penalties but also damage the reputation and credibility of the service provider.

Cost-Benefit Analysis

When it comes to investing in liability insurance as a service provider, it is crucial to conduct a cost-benefit analysis to determine the value it brings to your business.

Finding Affordable Liability Insurance Options

Here are some tips for service providers to find affordable liability insurance options:

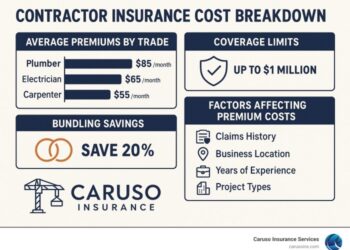

- Shop around and compare quotes from different insurance providers to get the best deal.

- Consider bundling your liability insurance with other types of coverage to save money.

- Opt for a higher deductible to lower your premium costs.

- Ask about discounts for factors like having a good claims history or taking risk management measures.

Benefits Outweighing Costs

While the upfront costs of liability insurance may seem significant, the benefits it offers can far outweigh these costs in the long run. Here's how:

- Protection from financial losses: Liability insurance can help cover legal expenses, settlements, or judgments in case of a lawsuit, saving you from potentially crippling costs.

- Enhanced reputation and credibility: Having liability insurance can instill trust and confidence in your clients, showing them that you are a reliable and responsible service provider.

- Peace of mind: Knowing that you are protected by liability insurance can give you peace of mind and allow you to focus on providing quality services without worrying about potential risks.

Case Studies and Real-Life Examples

When it comes to understanding the importance of liability insurance for service providers, real-life examples and case studies can provide invaluable insights. Let's delve into some scenarios where liability insurance has played a crucial role.

Case Study 1: Medical Malpractice Insurance

One of the most common examples of liability insurance in action is medical malpractice insurance for healthcare providers. In a case where a surgeon is sued for a surgical error that resulted in harm to the patient, having medical malpractice insurance can protect the surgeon from financial ruin.

The insurance coverage can help cover legal fees, settlements, and damages, ensuring that the surgeon can continue practicing without facing devastating financial losses.

Case Study 2: General Liability Insurance for Small Business Owners

Small business owners rely on general liability insurance to protect themselves from various risks. For instance, if a customer slips and falls in a retail store, the business owner could face a costly lawsuit for negligence. With general liability insurance, the business owner can cover the medical expenses of the injured customer and any legal fees associated with the lawsuit.

This coverage can prevent the business from going bankrupt due to unexpected accidents.

Success Story: IT Consulting Firm

An IT consulting firm faced a lawsuit from a client who claimed that a software solution they provided led to financial losses. Thanks to their professional liability insurance, the consulting firm was able to defend themselves in court and ultimately reach a settlement that was covered by the insurance policy.

This success story highlights how liability insurance can safeguard service providers from unforeseen liabilities and legal challenges.

Final Summary

In conclusion, the discussion on why liability insurance is essential for service providers sheds light on the proactive measures businesses can take to safeguard their operations and mitigate potential risks. By embracing the protective shield of liability insurance, service providers can navigate uncertainties with confidence and resilience.

Q&A

What does liability insurance cover?

Liability insurance typically covers legal costs, compensation payments, and medical expenses resulting from claims of negligence or damage caused by a service provider.

Is liability insurance mandatory for all service providers?

While it may not be a legal requirement in all industries, liability insurance is highly recommended to protect service providers from potential financial losses and legal liabilities.

How can service providers find affordable liability insurance options?

Service providers can explore different insurance providers, compare quotes, and tailor coverage options to suit their specific needs and budget constraints.